How Accounts Receivables Lose Value Over Time

As a businessman using an operating line of credit, have you ever asked yourself why your banker seems overly concerned with the aging of your accounts receivable.

Banks are generally conservative lenders and bankers know that accounts receivable become increasingly less collectible as they age. That is why advance ratios are generally low, and why banks will not provide any financing against accounts receivable that are more than 90 days old (for some industries the cut-off is 60 days).

It has been reliably proven that the value to your company of an old account receivable is nowhere close to its face value.

On the day your invoice is issued (assuming it is completed the same day as the sale is closed or shipped) an account is worth 100% of the face value, but as time goes by and the account remains unpaid, various costs start to pile up and…depending upon your profit margin…it is possible that you actually lose money on a sale if payment is not made in a realistic period of time.

Time is Money

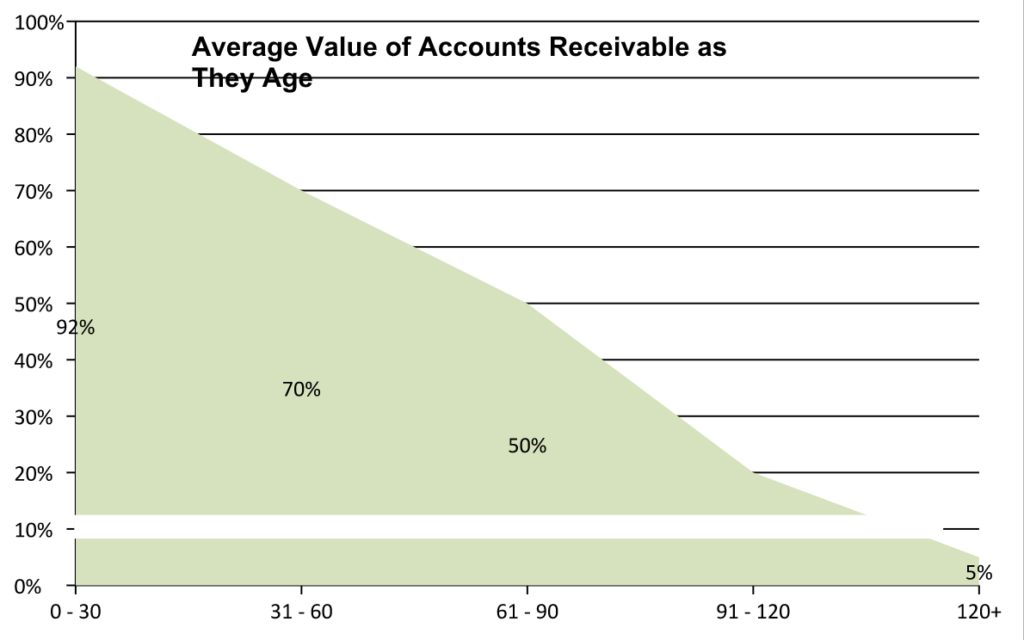

The above graph shows the value of accounts receivable reducing substantially over a short period of time. It shows collection of only about 20% of receivables once they are 90 to 120 days old. This value declines to about 5% after 120 days. This graph (depending on your business and types of customers) is a true estimate of the value of receivables over time.

Every business that offers credit needs to create and maintain policies that outline the processes for dealing with past due accounts. These collection policies need to be reviewed and updated on a regular basis. Every company needs to find out what works in keeping past due accounts receivables at a minimum. There will always be some accounts that do not pay and no option but to use a third party to recover the account. However, every company stay on top of these accounts and make sure they are contacted regularly while that account is still outstanding, to minimize this from happening.

Organizing Account Contact & Follow-up

Internal software can create a document or spreadsheet that will help to organize and schedule calls for consistent follow up of payment promises. Every effort should be made to optimize use of this software

Set Up Policies That Include Letter and Telephone Call Timing.

Write collection policies and procedures and incorporate them into daily routines. Ensure that they are reviewed regularly.

Ensure That Collections Are a Top Priority and Not the Last Thing Done.

Educate all staff on the importance of continued follow up and contact with your customers. Most businesses put the collections on the back burner. If you aren’t calling on past due accounts you run the risk of losing money and that hurts your ability to stay in business.

Set Time Frames For Letters, Phone Calls and Collection Placement.

As part of collection policies set the deadlines for collection notices and calls. Start making telephone calls on all balances no more then 5 days after the the 30-day reminder notice. By working with customers in a timely fashion a lasting professional relationship is created. When customers become delinquent on paying, they generally w avoid further business interaction. This is a loss of additional revenues stemming directly from lax on credit and collection policies. With proper strategy and training, everything can run smoothly and your revenues will be at their maximum.