How Much Working Capital is Enough?

Small business owners are often asked by their financial institution to support their request for working capital financing with a question such as “Why do you need that high a limit?”

Lenders are always concerned that a portion of a borrower’s operating line of credit (or working capital line) will become “locked in” …the line will not revolve below a certain amount.

In the eyes of the lender this will create a higher risk situation in the form of a loan amount that would be better represented by a term loan. Lenders often charge higher interest rates for term loans and specific security over fixed assets. It makes sense to them to try to eliminate any locked in portion of an operating line.

Many small businessmen do not have a thorough understanding of how to calculate the level of working capital that their company will need to handle day-to-day business and accommodate growth.

There is a calculation that Canova Bancorp uses to determine how much working capital a company really needs…we call it Working Capital Availability (“WCA”).

In order to complete the calculation you will need:

- Accurate balance sheets for at least 3 years prepared on an accrual basis

- Accurate assumptions about how your growth (or declined) creates change in current assets and current liabilities (accounts receivable, inventory, accounts payable, prepaid assets, short-term debt, deferred revenue, etc.

- Detailed financial assumptions of revenue and profit or loss for a going forward period of not less than 2 years

- Estimates of capital expenditures and other investments for the period that will not be financed by term debt or special financing

There is a series of steps that must be taken to calculate working capital needs:

1. Calculate Working Capital Available in Days (“WCA”)

Multiply the working capital amount (current assets minus current liabilities) from the most recent balance sheet by 365 days, then divide that total by the most recent annual sales revenue.

Working Capital x 365

Annual Sales Revenue

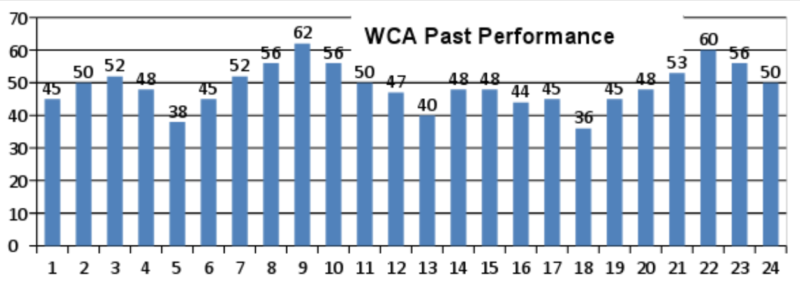

Make this calculation for each of the past 24 months using annualized sales revenue. The result will be a reasonably accurate t historical range of WCA, to wit:

The calculated WCA range is from a low of 36 days to a high of 62 days.

2. Compare your WCA to others in your industry.

Once you get your WCA for the last three years, compare it with industry averages. WCA is not a calculation commonly published for most companies, so you’ll likely need to apply the formula to the financial information available for your industry and for whatever you can find for specific competitors.

3. Determine an acceptable WCA range

Use best and worst case scenario projections and make your calculations as accurate as possible. This generally requires the use of a financial model for your business, complete with full balance sheet modeling. If you do not have that, then you can estimate based on industry averages and your actual historical performance. If you do have a financial model, plug in your best and worst case scenarios in terms of growth, expected customer payment periods, and inventory levels. You have to use projections for the ‘going forward’ period. You will be handicapped if you are only able to use historical information

4. Subtract capital expenditures paid for from working capital

Analyze the use of working capital for non-operating purposes over the next 12 months (I assume the future analysis will cover a one-year period). For any investment or asset purchases funded from working capital (i.e. – not financed) make a suitable deduction. The calculation should be:

Working capital balance (as calculated)

Less capital expenditures/investments not financed

Equals working capital available for next twelve month

5. Add or subtract projected profit or losses during the 12-month period.

Operating profits or losses will have an impact on working capital as well. For the coming 12 months add projected profits or subtract projected losses to calculate projected working capital available for the next 12 months. We assign an arbitrary amount of $300,000 for this post

6. Reverse the WCA formula to solve for working capital.

Now reverse the WCA formula to solve for working capital required (the amount of working capital required during the next 12 months).

This formula is:

WCA x Annual Sales Revenue

365

Let’s suppose annual sales revenue is projected to be $3,000,000.

A WCA of 36 = working capital of approximately $300,000 required.

A WCA of 62 = working capital of approximately $510,000 require

7. Calculate what additional financing you will need to meet your cash flow needs

Look at your average accounts receivable collection period and determine how much cash you will generate from sales revenue over the projection period. Compare this amount to the two WCA requirements calculated in #6 above. (Note – for the purposes of this post we have assigned an arbitrary value of $300,000).

With a WCA = 36 the additional cash requirements would be $0 ($300,000 – $300,000), however some precaution must be taken to guard against slow receivable collection, unforeseen costs etc. so arrangements should be made for additional operating line availability (suggest $100,000).

With a WCA = 62 the additional cash requirements would be -$210,000 ($510,000 – $300,000). That should be enough of a buffer to make additional operating line availability unnecessary.

Conclusion

Instead using only a single variable of WCA to run various scenarios, you should want to run projections at different sales revenue levels and make necessary adjustments as required. Once you are done, you’ll be able to clearly and confidently determine exactly how much additional cash flow, if any, you need to keep your business properly capitalized.